The Zero-to-Hero Portfolio

by elmads

Introduction

Welcome to the Zero to Hero Portfolio, inspired by the principles outlined in my book. This portfolio demonstrates how small, consistent investments in equity index funds can lead to significant financial growth over time. Regardless of one’s background or level of financial knowledge, this approach can transform a person from a novice investor into a financial hero for themselves and their family.

Why Did I Start This?

𝗧𝗶𝗺𝗲 𝗜𝗻 𝗧𝗵𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 𝗪𝗶𝗹𝗹 𝗙𝗼𝗿𝗲𝘃𝗲𝗿 𝗕𝗲𝗮𝘁 𝗧𝗶𝗺𝗶𝗻𝗴 𝘁𝗵𝗲 𝗠𝗮𝗿𝗸𝗲𝘁.

Your greatest allies in investing are time, compound interest, and consistency.

I’ve always shared my enthusiasm for consistently investing a small portion of my hard-earned money over the long term in a low-cost index fund. Set it and forget it, and then continue living my life.

It seems that many people are interested in my investment journey and have asked me about it. I’ve created various pieces of content, blogs, and even a book to share my knowledge about investing. Yet, despite all this, some people are still hesitant to start their stock market investing journey.

So, here’s what I’m thinking: I’ll create a public index fund investing account to show everyone how boring and unsexy it is, but also how rewarding it can be in the long run.

Why not just share my current investment portfolio? Well, that’s personal. Instead, I’ve started a new index fund public portfolio. 😁

The Concept

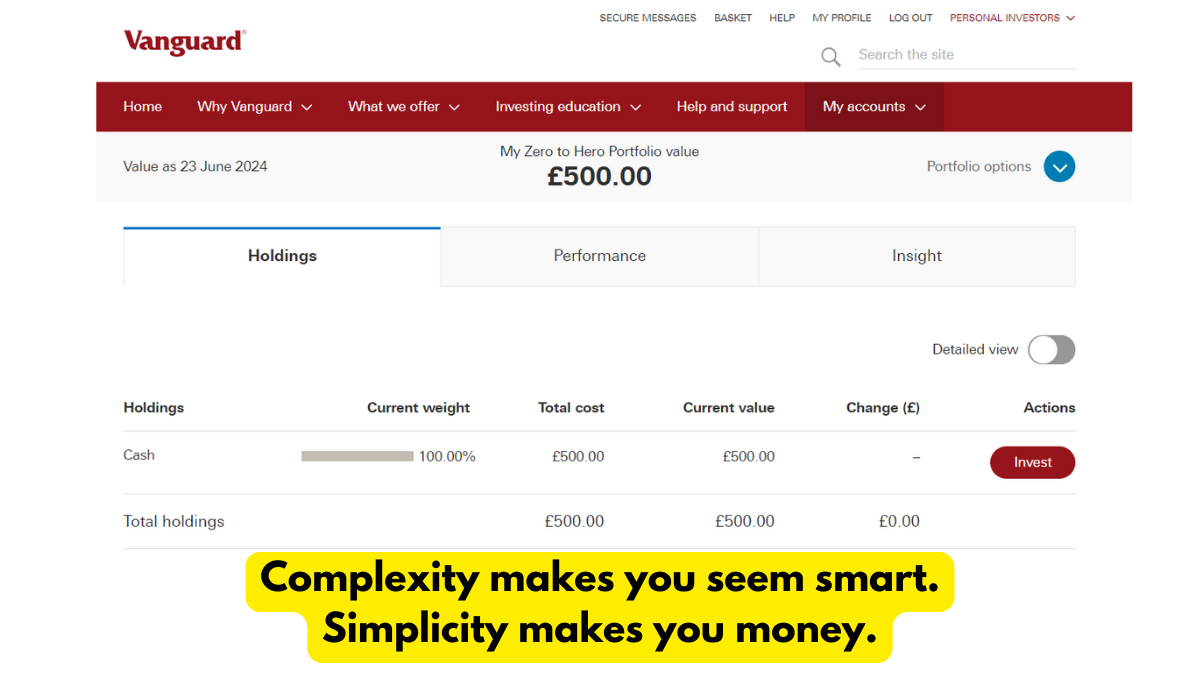

Starting with an initial investment of £500 (the required minimum to open an account with my chosen index fund brokerage) and followed by £10 per month in the Vanguard FTSE Global All Cap Index Fund Accumulation, this portfolio illustrates the power of regular contributions and compound interest. Designed to be simple, accessible, and effective for anyone, this approach emphasises consistency.

Why only £10? I was even considering contributing just £1 a month to show that even small amounts can be invested in an index fund. However, £10 seems a reasonable monthly contribution for anyone who want to start their investment journey but are hesitant or afraid to commit a larger portion of their hard-earned money towards their long-term financial goals.

The Goal of This Portfolio

To get comfortable with investing through index funds by dipping one’s toes in, then gradually increasing contributions as one builds confidence through learning, and finally being consistent and disciplined by staying the course. Building wealth from the ground up.

The Power of Compound Interest

“Most great fortunes are built slowly. They are based on the principle of compound interest, what Albert Einstein called ‘The greatest power in the universe.'”

—Brian Tracy

To grasp the potential of the Zero-to-Hero Portfolio, let’s break down the impact of compound interest. Compound interest allows your investments to grow exponentially as you earn returns on both your initial investment and the returns that the investment has already generated.

- 10 Years: After 10 years of investing £10 per month with a £500 initial investment, the portfolio could grow to approximately £2,641. This assumes an average annual return of 7%. For instance, your initial £500 might grow to £983, and the total monthly contributions of £1,200 (£10 times 12 months times 10 years) might grow to £1,658.

- 20 Years: After 20 years, it could grow to approximately £6,854. Here, the initial £500 could grow to about £1,934, and the monthly contributions of £2,400 (£10 times 12 months times 20 years) might grow to £4,919.

- 30 Years: After 30 years, it could grow to approximately £15,141. In this case, the initial £500 might grow to £3,806, and the monthly contributions of £3,600 (£10 times 12 months times 30 years) could grow to £11,335.

I did the computations using Investors.gov US Securities and Exchange Commission compound interest calculator.

Historical Performance: Using historical performance data, we can project the potential growth of the Vanguard FTSE Global All Cap Index Fund. Historically, the global stock market has returned around 7–10% per year before inflation. This historical average helps us estimate the future growth of our investments.

Remember the value of investments, and any income from them, can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

Cost and Fees

One of the significant advantages of Vanguard is its low-cost nature. Lower fees mean more of your money stays invested, continuing to grow over time. For example, if a fund has an expense ratio of 0.24%, a £10,000 investment would incur annual fees of just £24, maximizing the potential for growth. Account and Management fees are not yet included.

https://www.vanguardinvestor.co.uk/what-we-offer/fees-explained

How deep am I in investing? As of this writing, 90% of my net worth is invested in equities (for long-term financial goals), and 10% in cash and cash equivalents (short-term savings goals, emergency, and rainy-day funds). Of that 90% equity portfolio, 2/3 is invested in index funds while 1/3 is in individual stocks. That’s how committed I am to index fund investing. The initial money I’ve invested in the Zero-to-Hero Public Portfolio (£500) is 0.45% of my total net worth.

Getting Started and The Plans

Here’s how I started this Zero to Hero Portfolio and My Plans For It:

- Opened an Account: I began by opening an account at my chosen brokerage. The process was straightforward, requiring basic personal and financial information.

- Set Up Monthly Contributions: I set up a monthly direct debit of £10. It’s an automated process, so I can set it and forget it, ensuring consistency in my contributions. Regardless of economic and market conditions, whether the market is down or up, my monthly investment contribution will continue.

- Investing My Book’s Earnings: Any earnings from my book will be reinvested into the portfolio. For example, if I earn £3 in a given month, I will invest £13 (£10 regular contribution + £3 book earnings). If no earnings from the book in a certain month then only the regular contribution will be reflected on the account.

- Periodic Check-Ins: Periodically (quarterly), I check my portfolio’s performance to see how it’s doing. This is to ensure that the monthly direct debit contributions are being made as planned and also to see how this portfolio will perform.

- Transparency is key: I will openly share the portfolio’s performance, detailing contributions and the simple strategy employed.

- Long-term buy-and-hold: To continuously buy and hold Vanguard’s FTSE Global All Cap Index Fund Accumulation for at least 10 years, ideally extending to 30 years, while transparently documenting its performance for everyone to see.

- Living Life: Then, I get back to living my life, letting my investments work in the background. This approach reduces stress and helps maintain a long-term perspective, while making my hard-earned money make more money.

The Zero to Hero Portfolio is a public portfolio that showcases the journey of index fund investing. The downside though that it’s not flashy, not sexy and absolutely boring, but it’s what I truly believe works for the long term and would even outperform 70% of professional active fund managers.

To learn more about Vanguard’s FTSE Global All Cap Index Fund – Accumulation, check out the blog link below. In this post, I explore the details of this fund and explain why owning a slice of the global market is a straightforward and strategic path for my public portfolio.

Complexity Makes You Seem Smart. Simplicity Makes You Money.

This is a public portfolio that I’ll be sharing every month with everyone, along with up-to-date market news that may have influenced the stock market’s performance at that point in time.

For more on index fund investing or active investing, see my blog posts on my website at www.elmads.com.

For a more comprehensive story of my journey, how investing shaped my thinking and way of living, and why it’s also crucial for your own life, check out my newly written book, where the roots of this portfolio are explored: “Zero to Hero—The Rookie Investor’s Manifesto: Building Your Wealth From the Ground Up Through Stock Market Investing”.

You can explore my past monthly updates on my portfolio and market news in this archive:

The Zero To Hero Public Portfolio Monthly Update Archive

This blog is for informational purposes only and not a Financial Recommendation. Not all information will be accurate. Consult an independent financial professional before making any major financial decisions.

0 Comments