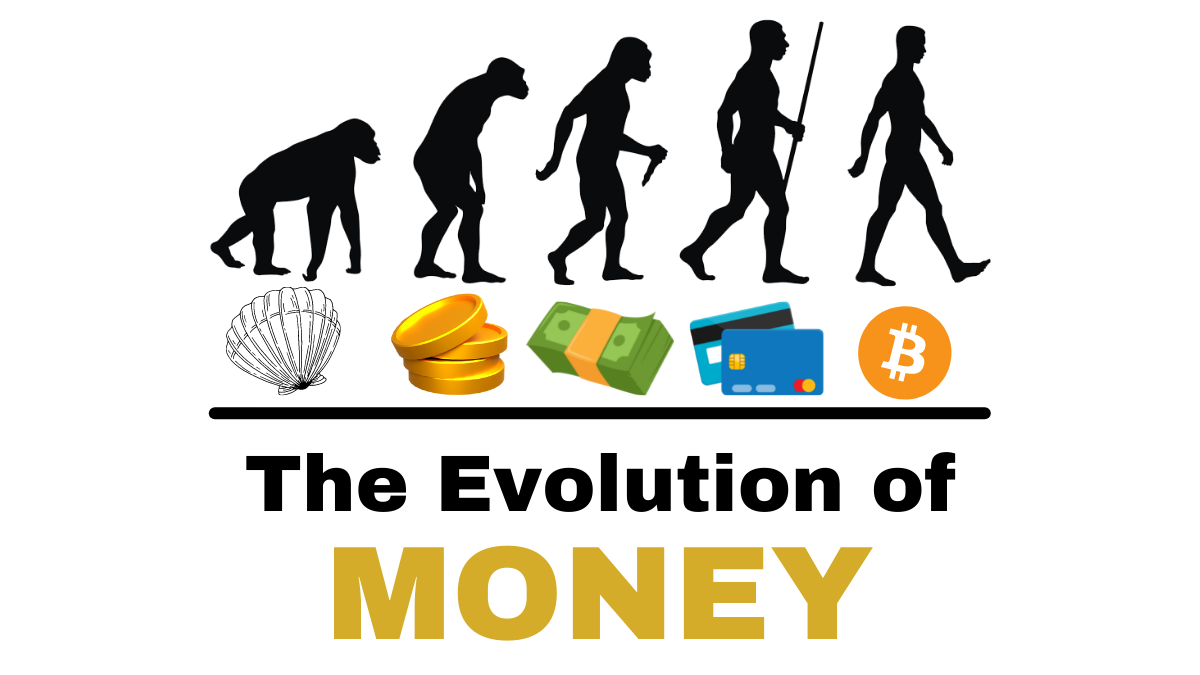

The Evolution of Money

By elmads

Everyone works for money in order to sustain their live. A harsh truth about the relationship of money and work, but it is not entirely accurate. Why is that? because some people do not work for money, others work because they love what they do and are very passionate about it. Money is only a means to an end, it is only a tool to attain what we truly deem important and want in our lives. For instance, buying a home in order to have shelter and safety of our family, investing so that our cash will grow without needing to work for the rest of our lives, or to travel the world and enjoy the memories with our loved ones.

This is the reason why money has been of significance, it bridges the gap between now and our future life goals. Nonetheless, before our cash based world dominated our transactions today, it first started as a cashless based world.

Barter trading

The past was a cashless based world, our ancestors used different methods to trade their goods and services. Some people used stones, sea shells, live stocks and did some services as a way of payment. This is what they called barter trading.

A lot of small tribes and towns before used this method because there was no specific trusted medium of currency that time. Imagine it as trading today’s basketball cards with basketball cards of the same value or bag with another bag.

Yet, this still gave problems as there is no exact exchangeable amount for every product that time, causing inefficient trade transactions. Think it this way, will a certain bag be a good exchange with a pair of shoes? you are probably thinking that it will still depend on the brand, but there were not Nike, Adidas, Louis Vuitton and Hermes before, there were only products. That itself is the dilemma with barter trade, not to mention if a livestock like a cow is a good trade for 10 baskets of fruits or 50 basket of fruits? Barter trading was all in the mercy of supply and demand of their surrounding areas.

Then came the once dominating Greek civilization who invented coins as a national mode of payment for each transaction.

The Coins & The Precious Metals

The Greeks civilization used coins in every trade that they did before. It gave them an exact exchanged amount for every products and services. It made transactions faster and easier for their citizens that time. The first currency emerged with the invention of the coins.

Coins where shaped and minted using metals such as silver and gold. The governments that time placed stamps on the coin as a declaration of the value and legitimacy of its contents. Unfortunately, there was still a problem with coins, it was to heavy to transported most especially to far away areas. Just think of transporting a large sum of coins from Greece to other neighbouring civilizations. The answer to this problem came after a few hundred years, and that is paper money.

The Rise of Paper Money

Believe it or not, it was China who invented the paper money under the Mongol Emperor of that time named Kublai Khan. He was very insistent and forceful for the merchant traders to use the paper money he created that time, the consequence for refusing his offer was death. The only problem in accepting paper cash during the Mongol emperor’s period was, no one accepted any paper money because the only trusted currency that time was coins, gold and silk products.

On the other hand, as time passed by, merchants accepted this method in order to leave the heavy coins behind. They made paper cash as a source to record how much money they had. Subsequently, governments followed and incorporated in their system the paper cash. They were able to convince the merchant traders to exchange the coins with the notes that the they made. From this point onwards, cash and coins have been used consistently to purchase products and service.

Credit since Time Immemorial

Before the well known credit cards that we use today were invented, verbal debt has been used first, during the time were barter dominated the landscape of trading. How? by just saying things between these lines;

“Hi Evan, can I get your basket of mango now, then I will trade it with my basket of apples after a week, will be that okay?”,

then Evan replies “Sure, as long as you give me the basket of apples after a week as you have promised.”

Debt, in simplest term is owing someone either money, item or service that we promised to pay in the future. It has been in the nature of people to have debt even during those early years of our humanity, that is why debt is also called the oldest probable means of trading.

Debt was related to slavery in the earliest times of human civilizations. Indebted individuals who are not able to pay their debts become slaves of their creditors. The debtors number of years of service, is the means to repaying their debts. The Roman empire utilized debt slavery during their rule and it unfortunately continued for hundreds of years. Then there came the Bailiff.

Bailiff are officers in the British Empire, they are responsible for executing decisions in the court. It is like our modern day of handling persons who are not able to pay their debts, through court procedures and trials. Once a person has been judged and found guilty, then the Bailiffs will go into the debtors house/premises to remove goods that will equal the value of their debt and send it to their credits for repayment. The dilemma with this method was that the taken goods usually exceeds the amount of debt that the person had.

Furthermore, after the bailiff, came imprisonment for the unpaid debtors and subsequently the current justice system that we have. This segregates the penalties and judgement passed of the indebted person depending on how much debt they have, what kind of debt they have and others more.

Money and debt will always go hand in hand, it is like the yin and the yang. Without one, there will be imbalances. That being said, we as persons should always know how to handle both money and debt in order to have the stability in our financial lives. This is because Debt can either make us wealthy or poor, depending on how we utilize its power.

What will be the Next Evolution?

I guess everyone has already an idea what will be the next currency and yes, that will probably be cryptocurrencies. They are digital currencies which does not hold physical form unlike our coins, paper cash and credit cards.

Cryptocurrencies are not the same with the money in our bank accounts. Because, 1st of all it is not a proper digital money and lastly cryptocurrency is decentralized. Meaning, there is no one government controlling and securing it.

For example, the US Dollars is under the protection and security of the US government, same as for GB Pounds of the UK, Chinese Yuan of China, Japanese Yen of Japan and others more. These governments (one entity) control their currency by either producing more money or restricting more money, hence the centralized system of these currencies. This is how they control the financial system of the country they govern

Decentralized indicates that there is no singular entity controlling the money, that is why we can make transaction without the banking system’s help. With cryptocurrencies it will be everyone in the ecosystem who will be confirming the validity of the cryptocurrency transactions. Yes, everyone can see the transaction because each block signifies a certain transaction with a specific code, but they will not see the specific identity of the person who made the transaction.

The transfer time, the risk of being hacked and the system failing with the current banking transactions are removed when people use cryptocurrencies as the mode of transaction. Nevertheless, there are also downside in using cryptos, and currently that is without the help of the banking system. If we forget our passwords, no one will be able to confirm and retrieve our passwords. If we transfer cryptos into the wrong person then that is the end of that, no banks will be able to assist us to rectify our mistakes.

I just want to clear things out with you, cryptocurrencies are not the 100% future currency, but they could. No one in this world, not even the geniuses of our current generation knows the future. What makes cryptocurrency very promising is the one supporting their ecosystem, and that is the blockchain technology (a digital ledger). It is the process and method how the cryptos are being transacted from one person to another. To give you context, without the internet we will not be able to use social media sites such as Facebook and Instagram. Same as cryptocurrencies, without the blockchain technology there will be no cryptocurrency transactions.

Understanding Cryptocurrency will take a lot of time, understanding and motivation to do so. It is true what we hear when other people say that this new emerging currency is revolutionary, because it is. The reason why it has been made, its goal and its purpose.

I made a microblog about Bitcoin (the current core of the cryptocurrency world). See link below.

To sum it up

The evolution of money plus debt has always been tied with the improvements of humanity. Money itself is only a tool that signifies what people want in their lives. It gave a quantification for transactions of products and services, but it also gave problems in every civilization.

It is not how much money we have, it is how we use that money to attain our goals. If we are doing it for the betterment of our lives and others then that is indeed good money.

I finish my blog with a quote;

“It is not money itself that matters, it is how we use it, which determine its true value”

ELMads

Knowledge is my Sword and Patience is my Shield,

elmads

This blog is for informational purposes only and not a Financial Recommendation. Not all information will be accurate. Consult an independent financial professional before making any major financial decisions.

0 Comments