Financial Literacy is not the Answer…

By elmads

Introduction

Think of this kind of life and be empathic about it, a life in which we are born into this world without any opportunity, coming into a life of poverty, no chance to even have the basic education. The only way to live is to work at an early age, experiencing negative energies being emitted in daily basis by our community, and everyone else have the same sentiments that no one has their back, not even the government that they expect to support them and alleviate their sufferings. Can you just imagine the stress, the anger, fear and anxiety, which all contributes to a massive hit in a person’s mental health.

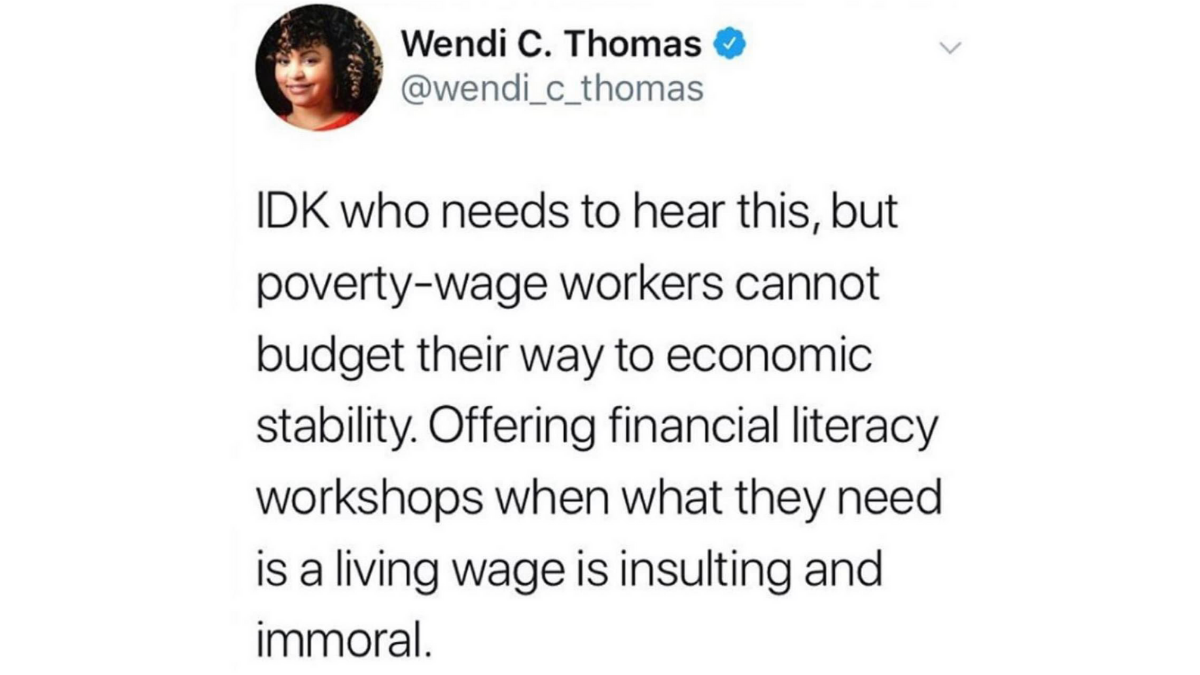

A life of hardship that a person shouldn’t even be experiencing, but still does. With the above post and scenario, came a question into my mind. As an ordinary citizen of this world, who is a proponent of financial literacy and education, how can I and others like myself think of a small solution for this? I know that I am not a billionaire, an influential person nor a politician. Hell! I am not even a licensed financial advisor, but I am a person who is really into helping others through personal finance and investing. So, when a person who is genuinely asking for help with such problem comes and seek assistance, what are the solution that we can actually suggest to them that is realistic, applicable to their financial state and most of all, attainable?

I’ve seen the above post shared for a couple of times in different social media platforms. It captured a lot of attention, support, different point of views and most of all misunderstanding between people. I do get where both sides are coming from, the side of the financial advisors who want to give support to others through financial education, and the other group who are into the belief that financial literacy is not essential for the low-income earners, the ones who are not even able to support their own life’s basic needs. While both parties have valid points, the only problem is that most of their views are only to prove who is right and who is wrong, a very tiny portion of them only tackled how to solve the problem itself.

The post gave me an inspiration to make this blog, I did this not to point out which group is right and which one is wrong, I made it for the purpose of sharing my insights, views and also the feasible answers to it. Yes, it is true that not everyone will have the equal amount of opportunity, but opportunities can also be built individually. I pondered, asked my friends and researched data regarding this matter. A probable answer that could help, but not the main solution to this millennia old of a problem. This blog is my way to suggest small ways to approach this matter.

Overview of the current Income Levels and Social Class status in the Philippines

To understand the problem, we need first to understand the country where we want focus our data research. This is because each country have different circumstances and economic structure. In this blog I’ll focus in my mother land the Philippines.

The Philippines is still considered a third world developing country by the United Nations.(https://worldpopulationreview.com/country-rankings/third-world-countries)

Third world developing nation defines as a developing country with a high infant mortality rate, limited access to health care, and a low GDP per capita . Despite this, the growth of the Philippines has been substantially increasing, thanks to its transition to a newly industrialized economy. It started from a country of agriculture to one based more on services and manufacturing.

Nevertheless, even with its faster growing economy, there is still a fundamental problem that, not just the Philippines faces but also most countries in the world, and that is poverty and their salary levels.

As of the 2020 data conducted by the Philippine Institute Development Studies (PIDS), the salary Range of Monthly Family Incomes (for a Family Size of 5 members) in 2018 prices, is the metric that they used to classify the income group levels.

NOTE: all information and illustrations presented from here on forward is taken from PIDS. See link provided below

(https://pidswebs.pids.gov.ph/CDN/PUBLICATIONS/pidsdps2022.pdf)

The Income group levels are as follows,

- Poor with Less than PhP 10,957 per month

- Low income (but not poor) Between PhP 10,957 to PhP 21,914 per month

- Lower middle income Between PhP 21,914 to PhP 43,828 per month

- Middle middle class Between PhP 43,828 to PhP 76,699 per month

- Upper middle income Between PhP 76,699 to PhP 131,484 per month

- Upper income (but not rich) Between PhP 131,483 to PhP 219,140

- Rich At least PhP 219,140

See table below for the data

See data presented in a slideshow format, for each major island of the Philippines.

As illustrated in the pie graph, poor income families have less than 10,481 PHP (210 USD) per month. They consist a total of 12% of the total household % of the Philippines as per 2018 data. That’s a significant percentage, these are the families who usually do not have any food in the table, unable to provide for themselves and their children, this is the poverty level in the Philippines.

Adding the household income group of Poor and Low Income (but not poor) make a total of 47%. Almost half of the families in the Philippines have less than 21,914 PHP monthly income, and these are the people who have the higher probable chance of living pay-check to pay-check. Thinking how to survive the day and tomorrow.

This is a reality in the Philippines, and may also be true for other places in the world. A problem that is old as the history of human race, a never ending cycle of poverty. It scars the people who has been living this life.

Financial Planning Recap

In my blog titled “Financial Planning Part 1”, I have tackled the basic step-by-step path into making our own financial plans.

Like anything else in life, we always start with the fundamental blocks, and that is always to secure our own base. An oak tree as thick and large as it is, will never be able to survive, if the soil where its roots are holding on is weak and soft. A chair no matter how beautiful it is, will always break and fall down if there are no legs to support and balance the whole if it. We’ll never be able to make a great financial plan pyramid if one of its bases is cracked, weak and incomplete, It’ll be like playing Jengga with only 1 block supporting all of its brother & sister blocks at the top.

CTTO: Kelvin (aka the Menga Man)

Like any other Financial Plan we start with Cash Flows, not Risk management and certainly not investing. What do I mean by this? We cannot save money to have an emergency fund, rainy day fund, sustain the payments for life and medical insurance and most of all to invest if the first and foremost problem is the main source of income. Remember that Cash flow is king, if we cannot find a source for it, then we will never be able to set our foot into economic stability.

This is the reason why financial planning will not be of significant help for low to very low income earners. Imagine this scenario, a person who is a low income earner will ask us for an advise regarding this specific problem, then we’ll be suggesting for them to save money, ramp up their savings for safety and security as soon as possible, get insurance, invest in stocks and real estate. WTF? really?When the main problem is the cash flow? that he/she is not even barely able to provide food for his/her family, let alone save money.

Helping is understanding a person holistically, being empathic about their current situation and finding ways that could help them, somehow to solve their problem in the short-term even in the itsy bitsy way. That small solution no matter how insignificant we think it might be, could actually be helpful for them, most especially when they do it with consistency, patience and with guidance. Atomic habits that they can do daily and for a very long time.

The small solutions to the problem

I was so bothered about the post for quite some time, because I do know for a fact that I am one of those low-income earners in the Philippines before. I experienced how hard it was to have less than 10,000 php per month in salary considering that I did not even have any children and family to support. That’s why the main photo above of this blog gave me a mental exercise, made me look for the possible ways that I could tackle this problem as an individual having a low income, which results to living a life of pay-check to pay-check or worse, getting into so much debt to sustain once necessities of life.

And here are the things that I was able to arrive into;

1.) Look for a higher paying job – Yes this is a no brainer, it is one of the solutions that everyone will be initially thinking of. If our current job salary is not enough for us to make a living then it is wise for us to transfer. It doesn’t meant that we will be resigning on our work immediately, what I mean is that to look for a job while still working on the current one so as to have a continuous flow of income.

2.) Having more than one job – This is literally “hard-work” in both of it’s double definition, working hard for money and having a hard time working. This is not the best answer to the problem, because having more than one employment is hard, we’ll definitely lose our personal time, be overworked and eventually get tired. Nevertheless, with the help of the internet, having a second job at home is now feasible. It is easier now than it was pre the internet age. (this is mostly like a side hustle), before when we say having more than one job, we need to be physically available in a certain job site and do physical service to physical customers. That’s why this traditional way of having more than two jobs are taxing and very stressful.

3.) Seeking union help – Not all jobs have union, but if you’re current work has one, please seek their help and advice. Unions are group of employees in the company who looks after their interests at work by doing things like:

- Negotiating agreements with employers on pay and conditions.

- Discussing big changes like large scale redundancy.

- Discussing members’ concerns with employers.

Unions are one of the factors that could influence a company or the government to increase wages. But, not most of the time. That’s why the 4th solution is important.

4.) Starting side hustles – In this information and digital age, starting a side income is attainable and doable, thanks to the internet. People could now do the following;

- Buying and selling items with mostly the help of our phones (Drop shipping)

- Investing & trading through mobile devices

- Online coaching in whatever topic or subject we are passionate about (educational teaching)

- Answering paid online surveys

- Freelance writing

- Selling products and services, and marketing it via social media sites (starting a business page)

5.) Keep on expanding our knowledge and skills – What’s an alternative way to do this if we do not have any access to formal education? Either, we go to public libraries and/or use digital devices and the internet to our advantage. The goal here is to have the skills and knowledge that is essential to attain an entry level job, or have the competitive edge in the markets so as to leverage the areas where there are opportunities that not everyone has seen yet. I do know that everyone needs a degree right now, but there are still some jobs in the Philippines that doesn’t require any bachelor’s degree.

Nevertheless, my main point here is to have other and additional knowledge and skills that could help us learn different things in our own way to generate more income. Most common is, learning the skills of sales, the buying and selling of products and services, which both doesn’t require a degree. It focuses more on how we will be able to make good products & services, and encourage people to purchase the goods & services we sell. Expanding also our network is key, as the more people we meet, the more they will know what we do, and the more we get to grow as well.

6.) Talk, Meet and Hear stories of other people, to createing our own opportunities – This is the most overlooked yet the most important. We only have one life, and that life could reach 100 years. In our lifetime, we will only be able to encounter less than 0.1% of worldly knowledge and skills. We learn not just from our own experiences but also from others. This is the reason why talking, meeting and understanding other individuals’ point of view are important.

One example I can think of is myself. I’ve been a nurse since 2011, and I was saying that the only way for me to have a better life is to work religiously in my profession and study more in order to climb the ladder of employment, hence a better pay. But, while I was convincing myself about that, I was trying to read a few books, heard podcasts and watched videos regarding investing and mindset at time to time. Then I went deeper into the great persons of the investing world, their successes and most importantly their failures. Yes I know that what I said is talk and meet people, but this is another way of meeting them, through their biographies in life. This in turn changed what I though I should be doing in my life, into what I was meant to be doing in my life.

I am still a nurse, but what I realized is that I was just lying to myself about what my life must be. I didn’t know at first that there are a lot of things life can offer, and now I’m trying to learn more about it, through other’s experiences.

What we get from them are the experiences that we might not even experience in our lifetime, but we get the chance to encounter due to their stories. Meeting, talking and hearing people give us other methods, processes, strategies and framework that can be helpful and applicable to our lives. It opens up other opportunities in the world that we didn’t actually know exists. It is like a baby learning new things regarding the world.

To sum it up

I didn’t include a good mindset in the list of solutions that I made. Why? it is because I am realistic to the fact that a negative mindset will be hard to change if the environment we live in is overflowing with it. This is the reason why I love solution number 6, Talk, Meet and Hear stories from other people. Yes, it is true that when we meet and talk to people, we will also capture their negative perception of life, but we also get the chance to capture the good side of it. The negative mindset and perspective of others can give us an insight, to what can make our lives astray, what can make things derail and pull us into the negative end of the spectrum. Or, the mistakes and failures of others can be a teaching lesson for us, who have not experienced what others have direly experienced already, and this can also present as a guiding path for us as well.

On the other hand, If we get lucky we might meet a successful person, success in terms of genuine happiness and fulfilment. Like a family man who is good with finances and focuses only for the welfare of his family and doesn’t succumb to the social pressures, a worker who has always been a model employee, a passionate janitor in an office who is genuinely happy in what he/she is doing, a domestic helper who works in a different country to sustain their family back home and loads more of “success story in their own way” kind of scenarios. Sky is the limit when it comes to learning all of the experiences and mindset from other people in various walks of life. That’s where one of the greatest opportunities of learning and growth can be found.

Yes poverty is and will always be a problem, and it will most likely never go away completely, but finding footing to be included in the economic stability is not entirely impossible. The importance of financial literacy is not about the math, it is about the mindset and behaviour, being pragmatic to our current scenario in life. In knowing what to do with our resources vs our wants & needs, then if it doesn’t add up either we need to be more efficient or find more/other ways to expand our resources.

Knowledge is my Sword and Patience is my Shield,

elmads

This blog is for informational purposes only and not a Financial Recommendation. Not all information will be accurate. Consult an independent financial professional before making any major financial decisions.

0 Comments