Simple and Compound Interest and the Net Present Value of Annuity & Life Insurance

by elmads

Simple and Compound Interest Using Bank Savings Accounts

In a bank savings account, specifically a fixed-rate savings account for more than a year, do you think you are really receiving the actual annual deposit rates that the bank states in their terms and conditions? Clearly not, because taxes would need to be taken into account, but it’s not just that.

Let’s say that there is a 5-year fixed-rate savings account giving 5% per year (net of taxes). My question here is: in that 5-year period, are you really receiving 5% per year on your initial deposit?

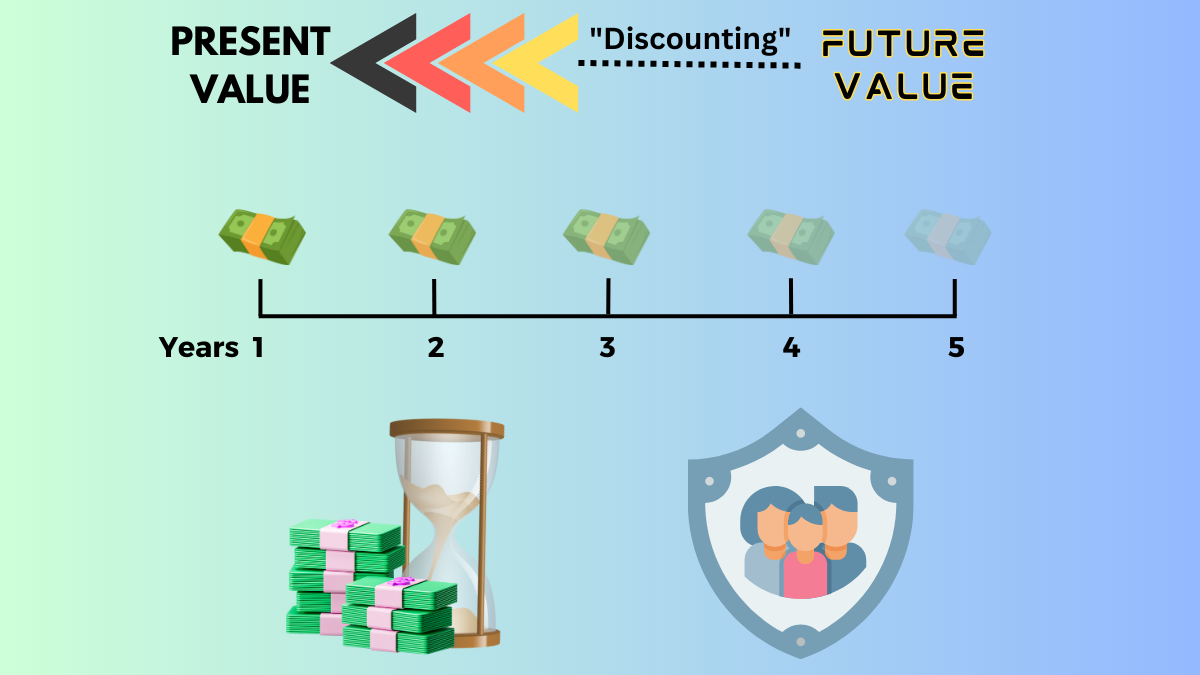

As shown in the above images, the annual return is less than the terms and conditions that the bank savings account said you would have received in the overall total of all your cash inflows. It’s not a bug; it’s just a feature of simple interest.

How about with compound interest? It is computing the interest based on both the principal amount and the interest received in the past, or, in short, interest-on-interest. We’ll use the same scenario of a 5-year fixed-rate savings account giving 5% per year (net of taxes) but using compound interest instead of simple interest.

It’s clear as day; compound interest wins all day. That said, it is rare to find a savings account that will give us annual compounding returns on our initial deposit, and if we do find one, it usually is on a fixed-term basis where we will not be able to withdraw money for a period of time, usually for years.

This is where utilising and maximising different financial vehicles based on our short-term, medium-term, and long-term goals will come into the picture.

My own guidelines and principles relating to it are as follows:

For my short-term goals (days 0 to 3 years), I place my money in highly liquid accounts, where I can access it and spend it within seconds.

For my medium-term goals (3 years to 10 years), I allocate my money to high-yielding certificates of deposit, fixed-term savings accounts, or bonds.

And lastly, for my long-term goals (more than 10 years), I invest my money in the assets that I understand. “Know what you own and why you own it” kind of assets such as stocks, real estate, commodities and cryptocurrencies.

Annuity

An annuity is an insurance contract between an annuitant (the person who bought the annuity) and the insurance provider. It is a financial vehicle that can provide a guaranteed income for an individual or their loved ones throughout their retirement. It is a risk management method for longevity. As technology and healthcare advance, so does our life span.

As per the United Nations Population Division and others (via the World Bank), the average global life expectancy today is approximately 72 years old. That’s a staggering 44% higher compared to the 1960s, and a double from 100 years ago.

Having a longer lifespan means the need for more financial resources to sustain our lives. Insurance companies formed the annuity contracts as a means to manage this specific problem. If life insurance is a risk mitigation method for mortality, annuities, on the other hand, tackle the longevity issue.

It provides:

- Practical retirement solutions

- Protection of our hard-earned money

- Income that cannot be outlived.

- It SUPPLEMENTS your retirement savings.

It works like any other insurance product, where the annuitant will either pay a lump sum or a monthly premium payment. It’ll make sure that your income will be safe from market volatility (fluctuations in price) and that you will have a reliable income source at the determined time when the insurance company starts giving you the money.

There are five types of annuities.

- Immediate Annuities: With immediate annuities, you make a lump-sum payment to the insurance company, and they start making regular payments to you immediately. This is a way to create an immediate income stream, often used by retirees who want a stable income.

- Deferred Annuities: Deferred annuities allow you to accumulate funds over time. You make payments into the annuity during the accumulation phase, and the payouts begin at a later date, typically during retirement. This type of annuity offers a way to grow your money tax-deferred before starting to receive payments.

- Fixed Annuities: Fixed annuities offer a guaranteed interest rate for a specific period. They provide a predictable income stream since the payouts are fixed and won’t be affected by market fluctuations.

- Variable Annuities: Variable annuities allow you to invest your premium payments in various investment options, such as stocks and bonds. The payouts you receive depend on the performance of these investments. Variable annuities offer the potential for higher returns but come with higher risk.

Don’t confuse Variable Annuities with Variable Life Insurance (VUL); the difference between these two products lies in their purpose. The former is designed to provide a source of retirement income, a means to create a stream of payments that can supplement your retirement savings, while the latter is for providing a death benefit to beneficiaries in case of the insured person’s death. It also has an investment component to potentially build cash value. - Indexed Annuities: Indexed annuities offer returns linked to a specific market index. They combine features of both fixed and variable annuities, offering the potential for growth based on market performance while providing some downside protection.

The two common types of annuities are Fixed and Variable annuities.

Think of fixed annuities as a standard bank savings account but placed in a insurance company of your choice, while variable annuities are mutual funds managed by the insurance company.

My reason for sharing annuities with you is to give you a broader view of various financial products in the financial world to cater your retirement needs.

Now, let’s move forward, into finding the Net Present Value of an annuity, so that if ever the time comes that you’ll consider taking an annuity, you will know which one to choose based on the information in the annuity insurance contract.

There are a lot of annuity products, of which we can gain a larger view of which one would be able to help us achieve our later-life financial aims.

Net Present Value of an Annuity

In an annuity policy, the details include how much money the annuitant will pay (either as a lump sum or as a monthly premium payment), how much money the annuitant will receive per year, when he/she will receive it, and for how long. This information is stated in an annuity policy.

A near-retired person plans to take out an annuity policy. He found two options that best suit his life and financial circumstances.

- Annuity A – requires $100,000 payment with a fixed payout of $3,500 annually for 20 years.

- Annuity B – requires $100,000 payment with a fixed pay-out of $4,000 annually for 15 years.

Both annuity policies state that if the annuitant dies during the payout period, his nominated beneficiaries will be the ones receiving the payout within the stated annuitization or payout period.

Assuming an interest discount rate of 7% (considering both inflation and unforeseen risks in the future), which one should this person choose?

It would take a substantial amount of time and effort to do a Net Present Value/Discounted Cash flow computation if we’re talking about more than 10 years. Imagine doing it one by one. Though Excel is very helpful, it is still time-consuming.

That being said, if the cashflows are the same all through the future years, just like in our example above, then we can use a variation of an NPV formula just for this.

Present Value = Future Cash Flow * ((1-(1+r)-t)/r)

Where:

PV = Present Value

FV = Future Cash Flow

t = number of years

r = Interest Rate

Note: The ((1-(1+r)-n)/r) formula is called the annuity factor.

The formula above is very helpful for longer years. Nonetheless, if the projected cash flow varies, then we don’t have any choice but to do a Present Value calculation for each and every cash flow.

Let us now compute the Net Present Value of the two annuities to assist our friend in our example in deciding which annuity policy to take.

Annuity A.

FV = $3,500

t = 20 years

r = 7%

NPV = ?

Annuity B.

FV = $4,000

t = 15 years

r = 7%

NPV = ?

In Annuity NPV terms, Annuity A has a higher NPV than Annuity B, which indicates that our soon-to-be retiring friend would be better off getting the former annuity policy.

NOTE: I know that the total NPV of both policy plans is negative, indicating that both policies are money losing options in the future, especially when inflation is taken into consideration. That’s the downside of fixed-term annuities.

Variable annuities, on the other hand, would most likely give better cash flows in the long run, provided that the market would not stagnate for decades as the payout of this kind of annuity is heavily reliant on market returns.

What we must always remember with annuities is that they only SUPPLEMENT your retirement savings. This shouldn’t be our main retirement savings pot, as the returns we get from our initial capital to buy that annuity policy would be poor, especially with fixed-type annuities.

Personally, annuities are the last option for a financial vehicle for your retirement planning.

Life Insurance

“A policy of life insurance is the cheapest and safest mode of making a certain provision for one’s family”.

-Benjamin Franklin

Life insurance is a real protection plan. It’s a financial concept that is strongly tied to one of the inevitables of life. It is the concept of death, from ashes to ashes, from dust to dust.

As what Ryan Holiday said, “Death is the only prophecy that never fails”.

The only thing that varies for each one of us is when will this absolute truth happen, which is a question that no one in this world will ever be able to answer.

It is a complete waste of time to even stop the inevitable, and accepting our fates as human beings is just as natural as accepting how we came into this world.

Despite this, it doesn’t mean that life is without meaning; it is the opposite. There are a lot of things to experience: the chance to encounter new individuals, explore unfamiliar places, expand our knowledge in various fields, refine our skills, and above all, nurture our spiritual and religious connections, an opportunity to enhance our health, fortify our mental well-being, and strengthen relationship and build experiences with our loved ones.

Other things are just trivial to be honest.

As the clock ticks, only a few people think of their loved ones who will be left behind. Particularly for the ones who are highly dependent on their resources to live their own lives.

We love them so much, yet we don’t think realistically about how we could protect them when the lord calls us earlier than them.

Is it not even worth your time to allocate your resources for them?

This might seem dark to comprehend for some people, but life insurance is a financial vehicle that is rooted in the reality of life and how to handle it pragmatically.

As I’ve said in the section on Annuities, “Life insurance is a risk mitigation method for mortality”.

Let me emphasise and elaborate on my point here by giving you a scenario in relation to the concept of insurance in detail by showing you the numbers.

The Importance of Life Insurance by Showing the Numbers

There are a lot of insurance companies globally and a lot of insurance products with several different types of life insurance policies. It is so overwhelming that it now seems hard to comprehend for most people.

Despite the changes and complexities included in today’s life insurance policies, most of them, if not all, are still rooted in the traditional life insurance policy, which is to provide money to the policyholder’s beneficiary if he/she passes away (death benefit), provided that the cause of his/her death and the time frame that the death happened are within the person’s insurance policy.

A person who avails a life insurance policy (called the policy holder) will pay a certain amount of money (called a premium), usually monthly, over a long period of time (this depends on what type of life insurance policy you took, e.g., term, whole life, and universal life, to name a few). The insured will get the amount of money (death benefit) as stated in his insurance policy only once he passes away.

I just want to emphasise this to everyone. Life insurance is NOT AN INVESTMENT! Again, it is ONLY a financial risk management tool for death.

I still don’t get this life insurance thing, Evan. To be honest, I can just save my money over time instead of getting life insurance and risking giving money to an insurance company that might not give it to my beneficiary if I pass away, or it might go into bankruptcy, or, worse, a fraudulent insurance company. I’ve heard a lot of these insurance company scammers in the past.

I hear you, brother; I absolutely get your point, and I acknowledge your doubts.

Don’t worry, I’ll do my best to paint a picture here for you, to shed even just a bit of light regarding life insurance, and to share how I think about this from a broader perspective.

I’m not here to change your mind or even to tell you what to do or not to do, but to give you options and give you a nudge to make your own decisions and judgements based on your own understanding.

Without further ado, let’s go.

Go where? As usual, my favourite part of showing a scenario and backing it up with numbers.

NOTE: The scenario below is a real-life insurance policy of a friend of mine. I will not disclose her name for her own privacy.

We have Person ABC, who took a term insurance policy back in 2019. She was 29 years old at the time. The details of her term life insurance policy are as follows:

- Policy Type: Term-Life Insurance

- Policy Holder: Person ABC

- Policy Start Date: 2019

- Policy End Date: 2058

- Cover Basis: Single Life, Level

- Coverage Amount/Death Benefit: £100,000

- Premium Payment Frequency: Monthly

- Premium Amount: £8.29 per month

How should we look at this information to make something out of it?

First, we need to know how much Person ABC would pay for the whole policy up until 2058, as this is the end date of her policy.

She pays £8.29 per month. We need to multiply this by 12 to get how much she would pay annually.

£8.29 x 12 months = £99.48 per year.

Then we multiply that by 39 years. Where did I get the 39 years? It is done by subtracting the policy end date from the start date. So that’s the year 2058 minus the year 2019, which gives 39 years.

£99.48 yearly premium x 39 years = £3,879.72 total premium payment for the lifetime of the policy.

You know what’s great about person ABC’s-level term life insurance plan? The premium she pays is guaranteed. This means that what she pays monthly stay the same throughout her policy. Thus, she will only pay a total of £3,879.72 once her policy ends in 2058.

Not bad, isn’t it, because if she passes away, her family will get £100,000 for a premium that is just less than 4% of her death benefit.

Coming back to your statement: “To be honest, I can just save my money over time instead of getting life insurance”.

That is indeed an option, but it is highly dependent on a person’s financial capabilities.

Going back to Person ABC. If she didn’t get an insurance plan in 2019, what if she passed away in 2020, only as a hypothetical example.

Would she have enough savings or investments to help her family that she left behind, for them to financially survive a couple of months or years without her? If not, her loved ones would most probably be forced to urgently look for additional capital, and what’s the easiest and quickest way? To go into debt and work tirelessly just to fill the lack of financial earnings power due to the death of the family’s primary financial provider.

On the other hand, if Person ABC has savings and investments that would suffice for her family to survive for months, or better, years, then she could probably not get a life insurance.

Personally, I would still take the insurance plan. Having investments and savings is a plus, but if you add life insurance to your financial arsenal, it completes your financial base.

Think of your financial life as a castle. Your income, your savings, investments, emergency fund, rainy day fund, life insurance, and a will and testament—basically, the financial planning pyramid of wealth protection, accumulation, and distribution—are all parts of the castle. It consists of the castle, the moat, the crocodiles on the moat, the archers, the soldiers, the central tower of the castle, the cannons, and a lot more. All are for the betterment and protection of yourself and your family. It’s a no-brainer.

But wait, there’s more. You see, this is not the full picture. There are a lot of factors that can influence the flow of money between premiums and the death benefit amount, but one of the most important is inflation.

Let me show you in detail how a term-level insurance plan helps you when considering your cost of living expenses and where inflation is taken into account.

Term Level Life Insurance of Person ABC. The Net Present Value

We’ll still use Person ABC as our main example.

When I talked to her, she told me that her family’s total household monthly expenses are worth around £2,000, which is worth £24,000 a year (some of their wants expenses are already included).

What I’ll be doing here is getting the net present value of all the future payments (premiums) of Person ABC as stated in her life insurance policy. As this is a guaranteed premium throughout the lifetime of her policy, we can compute the NPV of her cash outflow using the annuity factor formula, which is

=((1-(1+r)-t)/r)

NOTE: I used the 3% discount rate based on the historical inflation of the UK from 1990 to this day. Why did I choose the year 1990? It’s just the year I was born. It is just my personal choice. To be honest, I could use data since the 1900s, but I don’t see the meaning of using such an inflation number far back in history.

I know it is not common to do an NPV for cash outflow, but I still did it to show you that if ever Person ABC passes away, even in the 39th year of her policy, a few days before the end of her policy in 2058, she is still eligible to claim her death benefit of £100,000.

And by looking at that scenario, the net present value of all the cash outflow (premium payments over the 39-year period) plus the death benefit would show a strong positive NPV.

Nonetheless, it doesn’t completely say anything yet.

Would that £100,00 death benefit be helpful for Person ABC’s family in 2058? Sure, the £100,000 today relative to their £24,000 yearly household expenses would give her loved ones 4 years (£100,000/£24,000) of ample time to sustain their needs. But what if it happens after 15 years or 30 years? Would the £100,000 amount by then still be enough?

To somehow know the answer to these questions, we need to consider inflation.

We can do this in two ways.

1️⃣ We either need to get the present value of £100,000 in our own hypothetical year, choose when the death benefit will be claimed, and divide that amount by the current yearly household expenses of Person ABC, which are worth £24,000.

OR

2️⃣ We compute the future value of the yearly household expenses of Person ABC, depending on our own hypothetical year. We choose when the death benefit will be claimed, then divide £100,000 by it.

Let’s do both, starting with computing the present value of £100,000 and dividing it by the £24,000 yearly household expenses.

Understanding the Insurance Death Benefit by Putting the Numbers into Real-Life Context

We have Person ABC with a yearly household expense worth £24,000 for this year. Just think of this year as 2019, because that was the year when Person ABC availed of her term life insurance.

How many years or months would the £100,000 death benefit would her family be able to live with if she passes away in the 15th year (fiscal year 2034) since she got her term life insurance? The discount rate to be used is 3% (this is the average inflation rate of the GBP currency from 1990 to 2022).

We’ll do this by doing the first method by getting the present value of £100,000, and dividing that amount by the current yearly household expenses of Person ABC.

Compute the present value of £100,000 over a 15-year period with 3% discount rate.

- FV = £100,000

- r = 3%

- t = 15 years

- PV = ?

PV = FV/(1+r)^t

PV = £100,000/(1+0.03)^15

PV = £100,000/1.03^15

PV = £100,000/1.56

PV = £64,186.19

If Person ABC passes away after 15 years of her taking the insurance policy, which is in Fiscal Year 2034, then the £100,000 death benefit by that time would be worth £64,186.19 in today’s value.

Divide the computed present value of the death benefit amount by the yearly household expenses of Person ABC.

£64,186.19 / £24,000 = 2.67

This means that the loved ones of Person ABC would have 2 years and approximately 8 months to purely rely on the death benefit of her term life insurance.

Now we’re done with the present value, let’s now compute for the alternative, which is computing for the future value of Person ABC’s yearly household expenses, and see if we’ll have the same 2 years and approximately 8 months answer.

Compute the future value of £24,000 over a 15-year period with 3% growth rate.

- FV = £24,000

- r = 3%

- t = 15 years

- FV = ?

FV = FV*(1+r)^t

FV = £24,000*(1+0.03)^15

FV = £24,000*1.03^15

FV = £24,000*1.56

FV = £37,391.22

The £24,000 yearly household expenses of Person ABC would be worth £37,391.22 or £3,115.93 per month after 15 years using a 3% growth rate based on the historical 1990–2022 average GBP currency inflation.

Divide the death benefit amount by the computed future value of the yearly household expenses of Person ABC.

£100,000 / £37,391.22 = 2.67

The result is 2 years and approximately 8 months, which is the same as the first computation we did. How did this happen? It’s because we levelled the money flow playing field, and that’s through time. The value of something should be based on a certain point in time in order make a clear comparison and help us to make an informed decision.

In a nutshell, if Person ABC passes away in the 15th year of her policy and is eligible to claim the £100,000 death benefit, then her family would be able to live their lives for 2 years and 8 months by just purely relying on it.

What’s the plus here? Person ABC’s family would have an ample amount of time to find ways to generate income to sustain their lives without her earnings power. That’s 2 years and 8 months worth of time, to be exact.

Can you imagine the alternative? There is no money left behind for the family; instead of purely grieving and mourning for her death, they would also have financial stress on their plate.

How would they live their lives within a few months or just within a month if they don’t have the money kind of stress? That’s a double whammy, which certainly no one wants to experience at all.

A Dollar Today is Worth More Than a Dollar Tomorrow: The Time Value of Money

While I was doing this computation, an absolute truth suddenly came rushing into my mind. Death may come at any time, and no one knows when it will happen.

Thus, a question was formed. What would be the number of years and months that the death benefit would be able to cover the household expenses of her loved ones if she passes away in years 1, 2, 3, 4 or up until the year 39 kind of scenario? I just want to know each and every possible scenario for Person ABC.

As you know, I’m a geek with numbers and simulating scenarios, and putting a perspective on them gives me the thrill and excitement. Thus, I did each one of them.

The first table on the left-hand side is via the present value of the death benefit method, while the table on the right is through the future value of household expenses method. I used 3% as the rate for all of the table computations below.

You have to read the tables per row to understand the information.

For example, using the right table (future value of household expenses), go to row 5, indicating year 5.

It shows that the projected future value of the £24,000 household yearly expenses of Person ABC would be worth $27,822.58 after 5 years. If she dies on the 5th year, then her beneficiary, in this case her family, would receive £100,000.

That £100,000 in the 5th year would cover her loved ones by 3.6, or 3 years and 7 months’ worth of their household expenses, which is shown on the “Years of expenses covered” column.

Note: This information is not absolute; it is based on my own assumptions and projections. This would only be nearly accurate if:

- Person ABC’s household expenses will not increase over time. That they maintain their current spending habits.

- Inflation would stay at around 3% on average in the future.

- The insurance company will stay true to their insurance policy and will pay Person ABC’s beneficiary if she dies.

It might seem too much for you to see the tabular form of what I’ve made. For an easier way to comprehend the information, I made a summary line graph focusing only on the “years of expenses covered” column of both tables.

The x-axis (horizontal) is the number of years from 0 to 39, while the y-axis (vertical) is the number of years of expenses covered by the death benefit if Person ABC passes away in either year 1, 2, 3, and so on and so forth.

As shown above, the death benefit would be very helpful financially if the inevitable happens early in the life of the insured.

Whereas, the younger we are, the more likely it is that we won’t have large sums of money saved to cover the expenses of our loved ones if we pass away.

We can clearly see now the ultimate benefit of being insured. By just bridging the numbers and reality of life, we can make an informed decision that would benefit our own and our family’s needs.

Additionally, I’ll show you another tabular and line graph where I illustrate the common public idea of just saving money rather than getting life insurance as soon as possible. We’ll still be using the circumstances of Person ABC in this example.

Here are my assumptions:

- The average salary in the UK as of 2023 is £26,000.

- The average savings rate in the UK as of 2023 is around 8%.

- I’ll assume that Person ABC consistently saves 7.38% (lower than the average) of that £26,000 average UK salary, which would give us £1,920 yearly savings or £160 monthly savings.

As illustrated above, if Person ABC just saved £1,920 a year since 2019 and did not get an insurance plan, then her savings would only cover months of her family’s household expenses if she passed away early in life.

There’s a downside: the later in life you opt for life insurance, the more likely it is that your premium will be expensive. Why? Well, because the chances of having diseases and illnesses increase as we get older. And insurance companies put a hefty premium on individuals who already have medical conditions, as the chances of mortality increase with it; this in turn also increases the odds of them paying death benefits. Thus, to mitigate that risk, they increase the premium.

At the end of the day, insurance companies are businesses, not charities.

It is always wise to get a life insurance policy, especially when you have people who rely on you financially.

On the flip side, going back to the line graph above, the later the death benefit gets claimed, the fewer years and months the death benefit will be able to financially cover person ABC’s family household expenses. This is because the costs of living will continue to increase due to inflation while the death benefit stays the same throughout her policy plan, which in her case is £100,000.

Save Money and Get a Life Insurance Plan

As I’ve shown you previously, if Person ABC’s death benefit plan is claimed at the later date of her policy, then the amount of money her beneficiary would receive would only be able to cover a few years of her family’s household expenses.

But hey, surely, people would also have saved their own money on top of an insurance policy, hopefully.

We should remember that life insurance is not an investment; it is only a protection from mortality.

We still need to save and/or invest our money on top of our insurance policy or policies.

What do you think would happen if we saved money and also have an insurance plan?

If my friend, Person ABC, consistently saves money monthly for long periods of time on top of her insurance policy, what do you think will happen?

🌟Simulation time!

I’ll add and repeat again the probable scenarios of what if she dies on this and that year, 1, 2, 3, 4, up until the 39th year. How many years would her accumulated savings (£160 monthly or £1,920 yearly, based on the UK average net income and around 8% savings rate as of 2023 data) plus the death benefit, cover her family’s household expenses?

In the earlier years, the death benefit of the insurance policy of Person ABC will give substantial protection to her loved ones if she passes away in the earlier part of her life, but as time moves forward, that same death benefit would not give that much boost anymore as inflation would have eaten it already. This is where saving a portion of her monthly salary consistently on top of her life insurance plan would cover the life insurance’ long-term shortfall.

What if instead of just saving money, she invested it in an index equity fund? Then let’s simulate that as well, shall we?

So, as Person ABC lives in the UK, here are my assumptions:

- The average salary in the UK as of 2023 is £26,000.

- The average savings rate in the UK as of 2023 is around 8%.

- I’ll assume that Person ABC invests 7.38% of that £26,000 average UK salary, which would give us £160 monthly investment or £1,920 yearly investment.

- Person ABC will invest that £160 monthly savings in an equity index fund that mirrors the returns of the FTSE 100 index (one of the most followed stock market indices in the UK).

- We’ll use a 7% growth rate for Person ABC’s investments. This is the historical long-term total average performance (dividends + market price appreciation) of the FTSE 100 index.

As expected, the investments that Person ABC has made in our scenario significantly cover a large chunk of her family’s household expenses in the future. This would have been made possible due to the growth rate of 7% of her investments in the equity index fund, which is faster than the 3% assumed inflation in her household expenses.

If she ever passes away in whatever year, the death benefit would be added on top of her equity index fund investments.

With all of these scenarios I’ve made, there is only one thing that I want for Person ABC and all the people in this world. Firstly, I pray and hope that everyone will get their life insurance, especially if they have dependents, and lastly, that no one will claim their death benefits.

Sure, you shell out money for that insurance plan, but the fact that you didn’t claim any death benefits during the lifetime of that policy means that you are alive and well.

The greatest gift is being alive, being physically and mentally healthy, and enjoying each passing moment with our loved ones, while financially securing their future.

To Sum It Up

Simple interest, compound interest, annuities, and life insurance are integral components of the vast financial landscape. These systems and products are designed to cater our basic needs, offering protection for ourselves and our loved ones. They are rooted in the practicalities and realities of life.

➕Simple interest serves our short-term necessities and shields us from the unpredictable nature of the market. It’s a tool for short- to medium-term financial planning, providing stability in an ever-changing world.

✖️Compound interest, on the other hand, is for the daring and the bold. It appeals to individuals who embrace market volatility, those who manage risk with a steady hand, and even thrill-seekers who relish financial adventure. It’s THE capital multiplier.

👴👵Annuities, situated at the tail end of life, I can’t help but ask myself: is living longer a gift or a punishment, or perhaps a challenge? The answer may lie in how we’ve built our lives leading up to that fateful day. By then, possibly I’ll find my own response.

💖Life insurance, in its essence, speaks volumes. The person who takes it says, “I love you; I may still be here with you or not, and regardless of my faith, I’ll make sure that I won’t leave you in financial pain. I only want one thing for you, and that’s to live with you, be with you, and enjoy every moment of being with you. Remember, I’ll always cherish and love you no matter what life holds for me in the future.”

These concepts intertwine with the threads of our existence, forming a safety net in uncertain times. They guide us through practical decisions and emotional moments, securing our present and shaping our future. In the end, they symbolise more than financial tools; they reflect our dedication to those we care about and our journey through life’s intricacies.

Knowledge is my Sword and Patience is my Shield,

elmads

This blog is for informational purposes only and not a Financial Recommendation. Not all information will be accurate. Consult an independent financial professional before making any major financial decisions.

0 Comments