The Cash Flow Statement

By elmads

The cash flow statement shows both the inflows and outflows of the company’s money in a given period of time. The focus here is the movement of cash in the business. This is the one of, if not the most looked into part of the financial statement by investors because it tells the story of where the the company allocated their company.

When the cash inflow is greater than the cash outflow, that’s a good indicator of profitability of the company within a set time period. Just like on an individual level where a person has a higher income than their expenditures.

Cash flows are a means for a company’s survivability, it is to ensure that the company will be able to pay their debts, employees, basic company needs to continue their operations and also their investors. It is exactly the same with our personal finance, if we do not have sufficient cash inflows, we will then find it hard to sustain our basic needs, pay our debts (if we have one), cars, house and others more.

For this blog we will be utilizing again Apple Inc’s 2020 cash flow statement report. Just a note before we move forward, we need to be aware of two things. Firstly, the date of the report secondly, the minimum amount of money and lastly, the currency being used in the report. In this case it is in millions of USD, and both in the year 2019 and 2020.

Cash flow statement has three major sections. The Cash Flows from Operations, Cash Flows from Investing and Cash Flow from Financing .

- Cash Flows from Operations – As the name suggest, it is the cash that the company generates from their main business operations which will start from the net income (this is taken from the income statement), then there will be both additional and deduction amounts of money depending on the company operations. This will be discussed later in the blog.

- Cash Flows from Investing – This is where the company spent the cash for property plant and equipment or capital expenditures and investments on other stocks or bonds.

- Cash Flows from Financing – This section provides the overview of how the company financed their business endeavours on a certain time period. This is usually through debt acquisition and equity.

Cash Flows from Operations

Net income – This is the net income from the income statement section. This is the first part of every cash flow statement.

- Deprecation – This is the reduction of the value of an equipment due to natural causes like wear and tear. Most companies have equipment like computers and cars, the initial value that the company paid for that will eventually decline after a few years up until those equipment will be deemed no value anymore. In the income statement, depreciation needs to be placed as an yearly expense based on the depreciated amount computation. Whereas, in the cash flow statement it is considered a non paid cash out flow because the amount of money that the company paid for that property, plant & equipment had already been paid one off. See the graph down below for a clear picture of it

This is what usually happens when depreciation is reported in the income statement compared to the cash flow statement.

- Shared based compensation, deferred income tax benefit and amortization – these are usually only adjustments for the net income, because basically these amounts where not laid out or paid as cash in that same time period.

- Accounts receivable – this is the money that is owed to the company by their customers. If this is positive then it indicates that the money owed has been paid in that inclusive time period, but if it is negative then the money owed has not been paid yet.

- Inventories – Positive inventory means that the company sold some of it while, negative numbers indicate that they bought more of their inventory.

- Other assets – Positive means the corporation sold some of their assets while negative number indicate they bought assets.

- Other liabilities – If something has been paid off, then the difference in the value owed from one period to the next period has to be subtracted from the net income. If there is an amount that is still owed, then any differences will have to be added to net earnings.

Cash Flows from Investing

Capital Expenditures/Property Plant and Equipment (PP&E) – This is the where the company needs to spend some of their cash in order to run their business operations, this includes buildings, equipment, computers, furnitures, machines and vehicles. These are tangible assets that depreciates overtime, which is recorded in the income statement as a depreciated expenses per year.

- Investments – These can be investments on marketable securities like stocks, bonds and real estate which are not related to the business operations.

- Others – this can be different per company but usually this is connected to hedge investments, which is another investing strategy to mitigate the possible downside risks of investing in the marketable securities, such as stocks and bonds

If the number in here is positive it means that the company sold some of their investments hence cash inflows, whereas when it is negative that translates as cash outflows as an investment.

Cash Flows from Financing

- Stock issuance – This is the shares that the company is able to sell to the public. A piece of the company share sold is a cash inflow to the company when someone buys it.

- Dividends – The amount of money that the company paid to its shareholders. (not all companies pay dividends).

- Repurchases of common stock – This is also called as share buyback. It means that the company bought back some of their shares. When the company buyback their shares, the total shares outstanding will decrease which in turn also increases the stock market price of the company. Nevertheless, not all share buybacks are good most especially when companies buyback their shares at an expensive price levels, which further inflates the stock price.

- Borrowings /Issuance of term debt – As the name states, this is where the company acquired debt through bonds.

- Repayments of term debt – As stated, the company paying their debt obligations to their bondholders.

- Proceeds from/Repayments of, repurchase agreements and commercial paper – This is another form of borrowing from short-term debts (less than a year). These are debt instruments acquired in the money market fund, like the notes, bills and commercial papers.

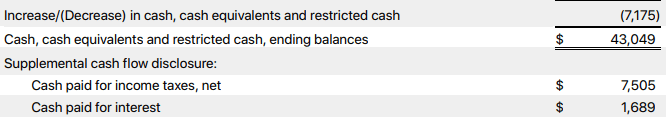

We then add the the total number for the Cash Flows from Operation, Investing and Financing in order to arrive into the total company inflows or outflows cash amount, in that specific time period.

Free cash flow

This is the cash left after subtracting Capital Expenditures for Net Operating Income. This cash can be used either to pay dividends for their investors, buyback shares of their own company, pay their outstanding debts or save it as liquid cash and retain it within the company. To compute the Free Cash Flow of the company, we need to subtract the Capital Expenditures/Property Plant & Equipment (PP&E) to its Total Cash Flow from Operations.

The is one of the most essential parts of valuing a company because the free cash flow is the representation of the money left for their investors and the company. Free cash flow is used as a valuation method to know the estimated fair value price of a company, via the Discounted Cash Flow (DCF). This is also used to value property and land for real estate investments.

To sum it up

The total cash flows can be positive or negative, the most essential part to understand in the cash flow statement is the prioritization of the company based on how they allocate their money. It is just like with personal finance, we make decisions based on our own priorities either, for our own basic needs, to support our dependents if we have one, personal expenses, savings as cash or cash equivalents, and investments. This is the wonder of looking into the cash flow statement, we can see how companies make their decision based on where the money goes. It is the company talking what is their goals for the company and its investors, via the cash flow statement.

Knowledge is my Sword and Patience is my Shield,

elmads

This blog is for informational purposes only and not a Financial Recommendation. Not all information will be accurate. Consult an independent financial professional before making any major financial decisions.

0 Comments