“IT IS CHEAPER TO PRINT THIS ON MONEY THAN PAPER” -The Zimbabweans

By elmads

It was a couple of months ago when I visited the British Museum. It was vast and overwhelming, especially the massive marble steps at the heart of the museum.

I went there for a specific reason, which was to visit Room 68 in Level 3 “Money”. What do you expect from a finance geek? hahaha!![]()

So, excitedly, I proceeded to the specified floor level. I took the museum’s massive marble steps (looking back, I should have used the lift instead ![]() ). Upon entering the room, I was sad and in awe at the same time. Sad because the museum only has one room dedicated to “money,” and awed because, despite being only a single long room, it is packed with artefacts relating to the history of money.

). Upon entering the room, I was sad and in awe at the same time. Sad because the museum only has one room dedicated to “money,” and awed because, despite being only a single long room, it is packed with artefacts relating to the history of money.

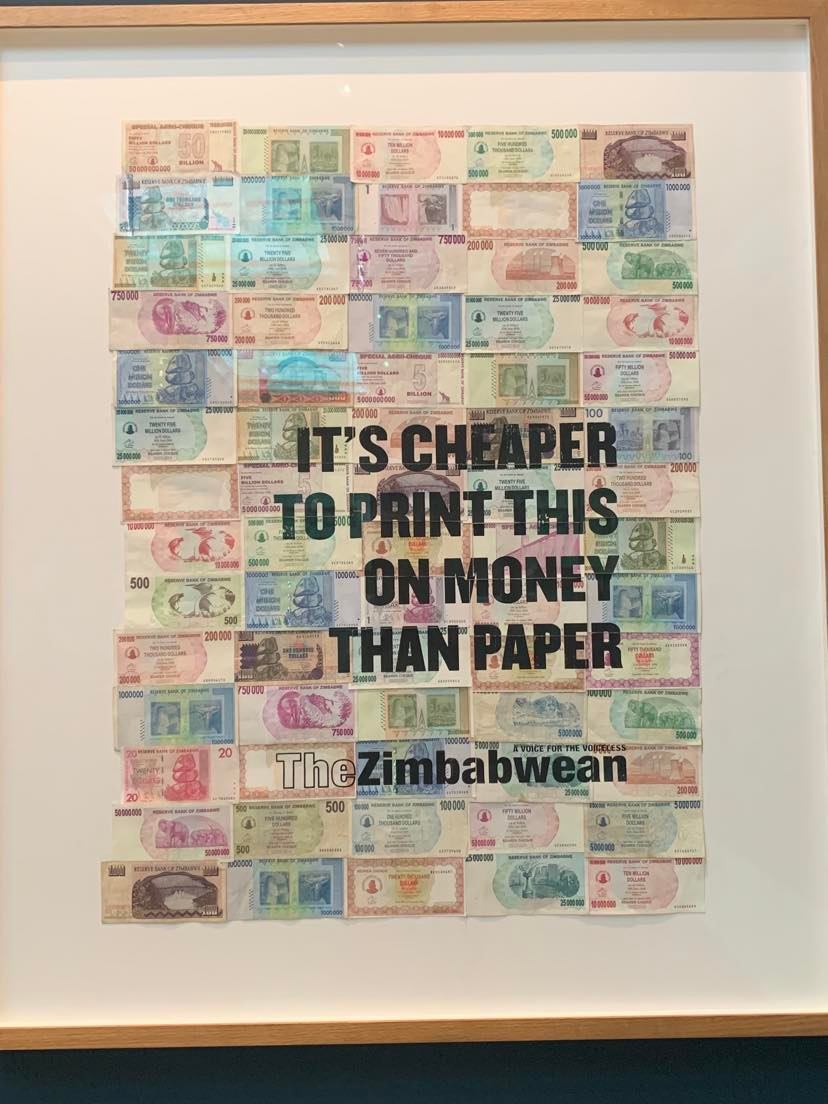

The photo I shared with you is one of the many interesting items in the “Money” room. It shows the previous currency of Zimbabwe (a country in Africa) called the “Zimbabwean Dollar” from 1980–2009.

It says, “It is cheaper to print this on money than paper.”

The Zimbabwean dollar had one of the most disastrous moments that a currency could ever have experienced in its lifetime: #HYPERINFLATION.

This is a phenomenon where a currency’s buying power tremendously declines over time, or, in more understandable terms, it is the massive price increase of goods and services in an economy.

Just think of how much you pay for your groceries monthly, then double that specific amount you pay every month. As in literally every month or in extreme cases, daily ![]()

![]()

In the 1990s, the Zimbabwean dollar’s MONTHLY inflation rate was around 50%, then in 2003 it was 600% MONTHLY, and the highest recorded was in November 2008 with 79 BILLION PERCENT THAT MONTH!!!! ![]()

During 2008, the exchange rate of 1 USD was equal to 2 billion Zimbabwean dollars, whereas in the 1980s it was 1 USD = to 0.68 Zimbabwean dollars. Talk about destroying Zimbabwean citizens’ purchasing power.

It’s true that money can be used as tissue paper, because the Zimbabwean people LITERALLY did it before. 𝐓𝐡𝐞𝐢𝐫 𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐲 𝐝𝐢𝐬𝐬𝐨𝐥𝐯𝐞𝐝 𝐢𝐧𝐭𝐨 𝐧𝐨𝐭𝐡𝐢𝐧𝐠𝐧𝐞𝐬𝐬.

The cause of their hyperinflation was attributed to the immense increase in their money supply with increasing national debt, a declining and weakening economy, and political corruption. It was a perfect storm.

This is why there are people around the world who understand the significance of blockchain and cryptocurrencies. For some, it is a means to make money, but for others, it is hope. Below is the link where Bill Miller further explains the significance of this.

0 Comments