Don’t Invest directly in Stocks as a Beginner, Only If. . .

by elmads

Introduction

I started investing when I was 23-years-old, this was back in 2013. It was all thanks to my dad and uncle, they told me that instead of just saving my money and putting it in a bank, I should invest it instead in companies that will grow overtime. If a company does well, so as the money I’ve invested on them. They told me to invest in companies where I and most people continuously purchase its products and services.

It was a straightforward advice from the both of them. And just like with everyone else today, who’ve initially heard, watched and read financial and investment educational books, articles, podcasts and video, I also didn’t start to invest immediately despite their advice. hahahaha!!!😂😂😂 (Well, back in 2013 no one talks and knows that much about equity investing yet, plus there were no finance & investing online contents back then unlike today).

The reason why I didn’t start investing immediately was that I was still not convinced about it, the fact that I need to put money into an account and let it grow overtime was to shady for me. I only trusted banks back then, I only thought that they’re the ones who knows more about making money. But, eventually I gave in and agreed to invest due to my dad’s never ending persuasion and encouragement.

Looking back, I am and will always be forever grateful to what they did for me, because without my dad and uncle, I would not have been exposed early to the world of investing.

In my lifetime, this has been one of the greatest gifts my dad gave me. A simple encouragement and support to start to invest, which I never expected to change the course of my life forever. Thank you Dad!!❤️

The Investment Strategy I Started with, from 2013 to 2019

No one in my family is a professional investor nor who does what an equity investor do for enjoyment to maximize investment returns. Looking into a company’s financial statement, company reports, for updates, the management, studying deeper into macro and microeconomic factors that can affect a company, its industry and its competitors.

Nevertheless, some of my family members do invest, included here are my dad and uncle. As I started to invest back in 2013 they gave me things to consider when choosing for a company to invest in. Their investment advice, was what I started with.

1.) Invest in companies that provide the basic necessities of the people, e.g. electricity, water, internet and etc – We don’t need a degree to know how important these things are. Even during economic downturn, people will always pay for their basic necessities of life. Hence, the businesses that provide our fundamental needs will most of the time be profitable.

One of my first investments back then was Manila Electric Railroad and Light Company (MERALCO), they have always been the largest electricity distributor in the Philippines.

2.) Invest in companies where you and most people that you have observed, regularly buy their products and services – The more people purchase a company’s goods and services, the more predictable and steady the income they could produce.

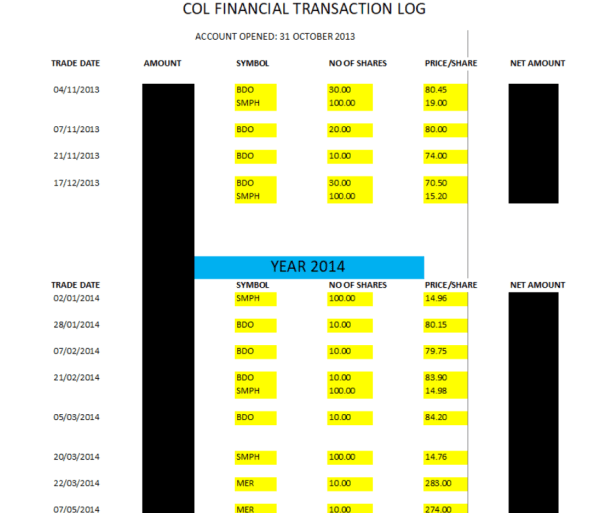

Back in 2013 and 2014, I’ve invested in two companies where I have observed that most people back then consistently utilize their services. It was Banco de Oro (Ticker: BDO) and SM Prime Holdings (Ticker: SMPH).

Banco De Oro (BDO) has been one of the top 3 banks in the Philippines. During that time, almost everyone in the Philippines had BDO as their bank. My thinking back then was, being one of the big 3 banks means that most savings of the Filipinos are held by them. The perks of becoming a big commercial bank.

SM Prime Holdings (SMPH), it has been one of the leading property developers in the Philippines, they’re widely known for their SM malls. The malls in the Philippines have strongly been a part of the Filipino culture, you’ll always see people inside these malls, most especially with the mega sized shopping malls.

3.) The more people spend, the more money a company will generate, and the less likely it will go into bankruptcy.

Today, I know now that this is just an assumption not a fact, but it was what I truly believed before.

Don’t Invest in Shares of Businesses if..

Please don’t invest in shares of businesses as a starting investor. I know that I am being ironic here because I started to invest in business shares myself when I was new in investing. But please hear me out first.

As the years progressed, and I invested religiously in the companies where I think would have done well overtime. I thought that investing was just simple as the advice my dad and uncle gave me, but it wasn’t.

As year 2019 came, my interest shifted back again into the investing world. I started to focus on it, learned bits and pieces of information, which completely opened the doors of the investing world for myself. To my surprise, the method that I did during that time was only a micro fraction of investing in businesses.

The investment strategy that I was doing since I’ve started in 2013 was called Cost Averaging or also known as Drip Feed Method, where I invest a portion of my salary regularly and consistently, without minding the price of the companies I was purchasing. I didn’t know about it until 2019. I found out that it was actually an effective strategy even up to this day.

The main problem here is not the method of investing, but where I invest my money. I invested in companies without understanding their business model, its competitive advantage, the management, and its valuations. A lot of things can happen in a company such as fraud and bankruptcy, and without the ample knowledge, I could have lost my years of hard-earned money.

I was blindly investing in businesses before, and was just wishfully thinking that they would do great just because a lot of people including myself purchase their products and services. I didn’t know that even a profitable company can fall from grace because of various factors that I didn’t know that could substantially affect a business overall. Like what companies you asked? Eastman Kodak (do you remember the go to cameras pre smart phone age?), Enron (Was the largest American energy, commodities, and services company), Lehman Brothers (One of the top 5 banks in the US before the 2008 Financial Crisis occurred), Nokia (Was a global titan in the mobile phone manufacturing business) and many more. I just got very lucky that it didn’t happen with the companies I invested during that time.

I truly believe that all of my returns from 2013-2019 was 1,000% sheer luck.

In short, don’t invest directly in stocks/shares of a companies if you are not planning to even learn the basics of the business you want to invest. Learning, acquiring more knowledge and acting on it, will always give us confidence and the ability to manage risk, hence peace of mind.

What do you Mean? Please Explain this Further

The investment advice my dad and uncle told me still holds true, but there are a lot more to it than that. A business is like an individual handling his/her finances.

An individual can have a large salary, but this doesn’t mean that they handle it properly. An above average pay, but what if he/she spends way more than what he/she can earn? which can lead to debt accumulation. Now bring this idea with a company.

Companies can still decline and whither overtime even if they are generating money now. How? with poor management, poor capital allocation, wrong investment decisions, strong competition that will eat their market share, and external macroeconomic factors such as pandemic and global financial constraints.

As an example, I’ll use the popular airline company in the Philippines named Philippine Airlines (PAL). They have been the flag carrier of the said country since the mid 20th century. Many people, both locals and foreigners use PAL as the airlines to go – to and from the Philippines.

So, in the lens of looking into it as an investment and following the basic principle of people utilizing a company’s products and services (The numbers 2 & 3 advice that I initially followed and practiced from 2013-2019), PAL seems to be a great investment isn’t it?

Looking back, if I knew that PAL was a public company during my first few years of investing, I would have probably invested a portion of my hard-earned money with them. That in mind, let’s look at PAL’s stock price from when I started in 2013 to today.

If I’ve actually invested back in 2013, then continued to contribute money to it overtime, my money would have been consistently negative even up to this day.

But why? how did that happen?! That’s Philippine Airlines! the flag carrier airlines of the Philippines, that’s impossible. Additionally, the CEO of PAL is a well known businessman in the Philippines, Mr. Lucio Tan.

It’s true, PAL is still very popular and a big company, with a lot of people still paying for their services, unfortunately that’s only a small portion of what is truly happening with the company. The decline in its stock price is due to a lot of factors such as with their poor capital allocation, monumental debts accumulated over a long period of time, an inconsistent and volatile profits (some years they’ll make money other years they’ll not) for decades now, and of course the negative impact of the pandemic to air travel. Adding all together these problems resulted for PAL to file Chapter 11 bankruptcy in the US in 2021.

If you want to know more about bankruptcy, you can check my blogs titled “Bankruptcy in the US” and “Bankruptcy in the UK & Philippines”

Don’t get me wrong, Cost Averaging is a good strategy, but it is mostly effective with index mutual funds rather than stocks. Nonetheless, if you’ll be doing the research and analysis of a company, and understand what risks it posses as an investment, then Cost Averaging in stocks could be a great combination for you.

I have blog titled “The power of Cost Averaging Investing” where I talk how great of an investment strategy it is even during the worst economic downturns of both the US and the Philippine markets.

The Valuation of a Company is Important

Valuation is defined as an estimation of the worth of something. In the case of investing, it is knowing the worth of a company based on their business cash flow.

Doing a valuation of a business takes a lot time, it takes a lot of research, the need to understand its business economics, and a lot of educated assumptions based from facts. In short, it is a long task to go through.

But what is its importance? it is knowing what is the estimated value of a company so that an investor would know if the stock price relative to the business operations’ future cash flow is cheap, fairly valued or expensive.

Unfortunately, it is not that easy because a cheap stock price of a company for you, can be seen as fairly valued or expensive for other investors based on their own valuations. It seems all around the place isn’t it? that’s why markets can be volatile as everyone has their own estimate of a company’s value, and different styles of investing. Not to mention, the majority players in the market are the traders, only a tiny fraction of it consists of fundamentalists and value investors.

That being said, there is an easy but inaccurate way to estimate quickly if the stock price is cheap or not. This is through the Relative Valuation metrics. One of the most popular is the Price-to-Earnings Ratio (P/E Ratio), which I discussed deeper in my blogs titled “Relative Valuation The Price-to-Earnings Ratio part 1” & “Part 2”.

A valuation can help to reduce the risk of us buying into a company’s stock price at sky high levels. That being said, when you do the Cost Averaging method of a company, you’ll not look into its price relative to its business cash flow. Don’t get me wrong, this method is still fine as long as the company consistently grows within the expectation of market participants.

What do I mean by this? the markets consists of different people, the institutional investors (groups of professionals who have monumental amounts of money, around multi-millions to billions of USD) and the retail investors (usually non-professional investors who have small amounts of money to invest relative to institutional investors). The investment institutions have professional analysts that also value companies, and have their own expectations of the growth of a business in terms of cash flow, revenue, EBIT, net income and whatnot.

Some companies are expected to grow massively year-on-year (roughly more than 20%), they are the so called Growth Stocks. The significance of this is, if a company is expected to grow faster in the future, the more likely its stock price will be trading in the expensive price range relative to the cash flow it generates today (like 20x, 30x, 40x or more than its current net income). Why? because it is expected that the net income will quickly reach the market capitalization the market bids its price.

Basically, investors are willing to buy the company at 30x or more the current net income generated by the business, because after a few years, it is expected that the company will be able to generate that perceived value of its stock price today via the company’s future net income.

That’s also where the high probable problem occurs, because when the expectation of the markets are not met by the company, then its stock price could turn into the opposite direction quickly.

One of the best examples today, which happened in 2022, was with the 70% stock price crash of Netflix. Their stock price went down and reached levels where it was last seen back in 2018, that’s 4 years of gains erased only within 4 months.

Let’s use my previous way on how I invest in companies and see if Netflix would pass my initial investment method, shall we? Netflix is a streaming services platform where people can watch different documentaries, series and movies on demand. As of year 2022, they have 200 million subscribers worldwide.

Everyone I know is subscribed with Netflix. This is already a complete check based on my initial (2013-2019) investment strategy checklist. So let’s see what would have happened if I started to do the Cost Averaging Strategy on Netflix starting from 2013 (the 1st year where I started investing) to today.

To be fair, I would have done great from 2013-2021 as the company share price went up over that time period. Unfortunately, the price substantially dropped in 2022, it reached levels not seen since 2018. Would I still have made money despite the drop? based from my historical amount of money contributed from 2013 to today, and the compounding calculations I made. I would still have been significantly in the negative up to this day. Whew!😔

I would probably have panicked and questioned what happened (if I just invested blindly and still followed my initial investment strategy and principles, and have not transitioned into active value investing), and presumably sold my holdings due to the fear that it might just continue to go down, or worse go to zero.

What caused this? Is Netflix a dying company already? actually that’s not the case. They are still very profitable, a money making machine. What changed is the speed of growth of the company. It’s expected for Netflix to be a fast growing corporation, but with the recent earnings report, it seems that their growth has been slowing down, which is a disappointment from the majority analyst projections. This can be contributed to the very tight competition in the streaming services – it has been a very heated battle that people call it as the “Streaming Wars”, and also the current economic conditions.

In terms of relative valuation, Netflix has had a median Price-to-Earnings Ratio, from 2013 to today of 191x (shown on the photo below). As of August 2022, their current Price-to-Earnings Ratio is around 20x.

Investors were willing to pay a high P/E ratio before (191x their earnings), because they expected the company to grow really fast in terms of their income, but the speed of growth slowed down already. This is why the Price-to-Earning multiples that the majority market participants are willing to pay today went down, based from Netflix’s recent earnings, hence the massive decline of its stock price. Analysts call this re-rating of the market stock price relative to the business of the company.

I know that it is hard to understand these jargons most especially if you’re a new investor. But in a nutshell, what I mean here is that doing Cost Averaging in a company that is trading at the expensive level can be a high risk investment, because once the cash flow expectations of the company negatively changes, then its stock price will surely be hit, which will also substantially drag down your portfolio returns. And seeing the price of your investments go down without understanding why you own it in the first place, will certainly make you feel very anxious, agitated and afraid. This makes most new investors sell their investments at a loss.

Instead of making more money through investing, they tend to lose more money.

The dangers of investing directly in businesses is not knowing why you own the business and not knowing how much you’ll be paying to acquire the business.

Again, our mindset is, we buy real businesses with real people operating the business in behalf of its owners/shareholders.

To Sum It Up

As I learned more about investing, I did further realize that I was just a lucky kid who was able to invest in companies who were genuinely doing great with their businesses. My returns back then were due to sheer luck.

The worst thing that could happen in a new investor’s or even trader’s journey, is to keep on making great returns on their investments at the start, thinking that it’s just so easy to make money with it. Then when they start to handle large sums of capital and still utilizes the same strategy, they might just realize late that they’ve just been lucky and eventually would have lost a monumental amount of their money which they have saved and invested for a long time. The market always has a knack, to make someone (Investors & Traders) be humbled.

“The best investment you can make is an investment in yourself. The more you learn, the more you’ll earn”

-Warren Buffet

In my own personal opinion, with my amateur years of learning, having the skin in the game, and knowing what I know now. If I would talk to my 2013 younger self who was just starting to invest, I would say two things to him;

1.) If you don’t want to understand investing in a deeper level, doing analysis, research and such, just do the Cost Averaging investment method with a Low-Cost Index Mutual Funds.

2.) But, if you’re willing to do the work, then go with equities, real estate, cryptocurrencies, commodities and/or the other assets. As long as you make sure that you’ll never stop learning, unlearning, relearning, continuing to grow and honing your arts, crafts and skills forever.

3.) Whatever you choose, please remember to always enjoy the process. The process itself is way more important and fulfilling than the results. 😊

Knowledge is my Sword and Patience is my Shield,

elmads

This blog is for informational purposes only and not a Financial Recommendation. Not all information will be accurate. Consult an independent financial professional before making any major financial decisions.

0 Comments